U.S. Power Sector: Looking Ahead to 2025

Posted: January 22nd, 2025

Authors: Rich H.

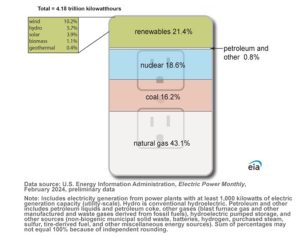

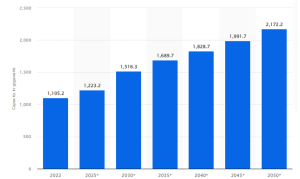

The power sector in the United States is poised to change significantly in the next 25 years. The rate of power generation has remained relatively flat over the past 20 years, largely due to the wide scale deployment of residential rooftop solar panels and widespread improvements in energy efficiency (Figure 1), and since 2019, the U.S. has produced more electricity than it has consumed. This relatively static need for capacity has eased the process of retiring older fossil fuel plants and replacing them with newer, more efficient plants and renewable energy generation. In fact, by 2023, the contribution of renewables of all types to the U.S. power mix was more than the contribution from coal-fired power generation or nuclear power generation (Figure 2).

Figure 1: Electricity Generation by Major Source, 1950-2023

Figure 2: U.S. Electricity Generation by Source Type, 2023

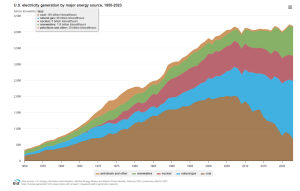

The days of static power demand growth are over, with the anticipated generated capacity needs expected to nearly double by 2050 (Figure 3). To accommodate this massive power demand growth, the United States will need to rapidly deploy new power generation facilities of all types: natural gas-fired plants, solar, wind, hydro, and potentially nuclear. Here at ALL4 we’re already seeing this shift as our partners in the power sector are actively considering new facilities and expansions at existing plants across the country.

Figure 3: Projected Power Sector Capacity 2022-2050 (GW)’

The primary drivers of power demand growth are the explosive growth of data centers, the increased energy needs to power electric vehicles (EVs), and the energy needs associated with the use of Artificial Intelligence (AI) in all aspects of computing. AI searches, while incredibly powerful, require as much as 10 times the electricity of a typical non-AI search using one of the common search engines.

No one solution will be enough to meet the projected capacity needs. Rather, it will be a mix of new fossil fuel-fired capacity in the form of natural gas (and potentially hydrogen), continued expansion of utility scale wind and solar power plants along with battery storage at a utility scale, and the continued development of small modular nuclear reactors (SMR). Various programs, including environmental justice initiatives in many areas, have increased public awareness of energy development projects resulting in skepticism and sometimes open hostility to expansion and even repowering projects. Developers will need to use effective communication and engage the local communities around the projects to alleviate concerns and avoid project delays.

Regulatory Environment in 2025

The trend over the past twenty years, though dependent on which administration was in power, has been an increase in regulatory oversight, especially in the case of fossil-fuel plants. On the air side, this includes regulating emissions of regulated new source review (NSR) pollutants, hazardous air pollutants (HAP), and greenhouse gases (GHG). New non-air rules were also passed related to wastewater emissions and coal-ash, specifically targeting the coal-fired power industry. ALL4 anticipates that the Trump administration will be far less active in terms of regulatory action, and many currently proposed rules, or rules that were finalized during the Congressional Review Act (CRA) period (after August 16, 2024), are likely to be stayed, delayed or weakened. The rules that we are watching in 2025 are highlighted below:

- U.S. EPA issued a new set of Effluent Limitation Guidelines (ELG), managing wastewater discharge from coal-fired power plants, in April.

- The Biden administration proposed a federal coal combustion residual (CCR) permitting rule in May, 2024, but never finalized it, and it now appears it may never be finalized. Meanwhile, several states have petitioned to manage their own CCR permitting rules and are in various stages of approval.

- Standards of Performance for New Stationary Sources (NSPS) for Greenhouse Gas Emissions From New, Modified, and Reconstructed Fossil Fuel-Fired Electric Generating Units: 40 CFR Part 60, Subpart TTTTa was finalized in April 2024 and the U.S. EPA recently denied all petitions to stay the rule. However, ALL4 anticipates that the new administration may move quickly to reverse or revise the rule. Emissions Guidelines for GHG emissions from coal-fired plants that do not plan to permanently shut down by January 1, 2032, were also finalized last spring under Subpart UUUUb. U.S. EPA said at the time that they were further considering emissions guidelines for combustion turbines, but such a rule is not likely to be a priority under this administration.

- An updated NSPS for Stationary Combustion Turbines (Subpart KKKKa) was proposed in December 2024. As I discussed in my blog on the topic, the proposed rule would define post-combustion selective catalytic reduction (SCR) as the best system of emissions reduction (BSER) for most base-loaded combustion turbines and set the nitrogen oxides (NOx) emissions limit for natural gas-fired turbines to 3 ppm. Because most newer large gas-fired combustion turbines already use SCR and are typically limited to more stringent NOx emissions rates through best available control technology (BACT) or lowest achievable emissions rate (LAER) requirements, the proposed Subpart KKKKa standards for these units could be finalized with minor revisions. Aside from the proposed limits for large turbines, there are other proposal provisions that may merit comment and may be revised. The rule is required to be finalized by November 2025 in accordance with a consent decree.

- Revisions to the revised National Emissions Standard for Hazardous Air Pollutants (NESHAP) for Stationary Combustion Turbines (Subpart YYYY) are expected to be proposed in mid-2025. There is no regulatory deadline for this update, but it is in response to a petition for reconsideration on the 2020 Risk and Technology Review (RTR) and U.S. EPA has to “gap fill” because there are types of turbines that are not currently subject to standards.

Additional ongoing regulatory issues that are of concern to the power sector include: The Good Neighbor Plan (currently stayed), the next Regional Haze Rule planning period, and the Mercury and Air Toxics Standards (MATS).

ALL4 will continue to track developments in regulatory and technical requirements related to the power sector in an era of expanding demand growth. ALL4 has significant power sector experience related to permitting and compliance for electricity-generating facilities of all fuel types combined with established working relationships with numerous state agencies and U.S. EPA. ALL4 provides a full range of environmental health and safety (EHS) and data services to our clients to help them meet their permitting, monitoring, testing, recordkeeping, and reporting challenges. If you’d like to learn more about our capabilities in the power sector, please contact Rich Hamel or your ALL4 project manager.